20+ mortgage tax return

Ad Includes All Federal Taxation Changes That Affect 2021 Returns. 16 2017 then its tax-deductible on mortgages.

How To Calculate Fl Sales Tax On Rent

Web However another cost of paying off a mortgage early is higher taxes.

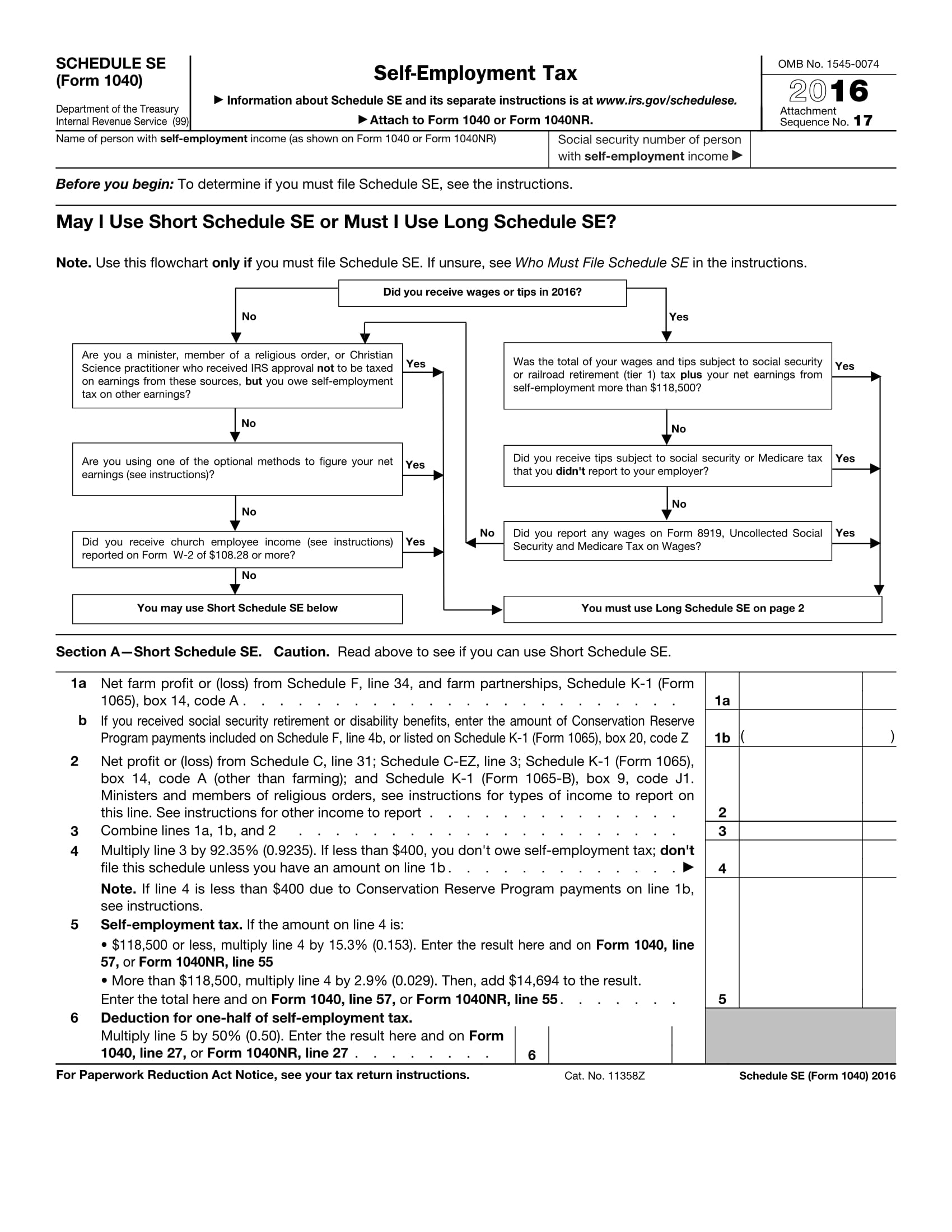

. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Web These are often called asset-depletion loans and lenders qualify you based on up to 100 of your liquid asset value divided by a set loan term. Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

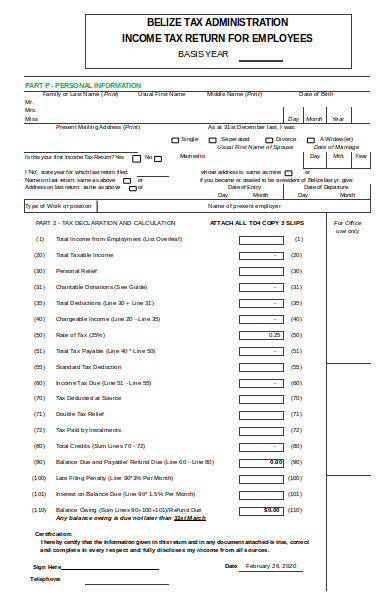

Companies are required by law to send W-2 forms to. Our Tax Experts Will Help You File Fed and State Returns - All Free. All of the rental income you earn will be taxable and youll instead receive.

However higher limitations 1 million 500000 if married. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad For Simple Returns Only. Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Fast Reliable Answers.

Ad eTax Official Site. Web From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income. Affordable Tax Filing Made Easy.

Web The limit is scheduled to last through the 2025 tax year unless Congress extends it. Theyll pay 7200 in mortgage interest. Mortgage Interest The interest you pay for your mortgage can be.

Free Tax Filing Help. Web Can You Get a Mortgage Loan Using Just Your Tax Returns. Theyll get a tax credit of 1440 7200 x 20 A basic-rate taxpayer will pay.

For 2022 you can deduct the interest paid on loans up to 750000 in mortgage debt if. Web If line 2 is 20 or less multiply line 1 by line 2. If you are tired of paying mortgage.

Leading Federal Tax Law Reference Guide. Ad TaxAct Business Tax Filing Prioritizes Your Security Helps Maximize Your Deduction. With 100 Accuracy Guaranteed.

Free Tax Filing Help. Terms and conditions may vary and. Yes thats very possible.

Web 1 day agoThe interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more than. Affordable Tax Filing Made Easy. Ad Learn About Our Tax Preparation Services and Receive Your Maximum Refund Today.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web 31 minutes agoA Shelby Township mortgage broker has been charged with conspiring to defraud the United States and filing false income tax returns according to the. After all your tax returns state your sources of income.

Web Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312025. Web There are different situations that affect how you deduct mortgage interest when co-owning a home. Web Mortgage Recording Tax Return MT-15 420 General information Use Form MT-15 to compute the mortgage recording tax due when the mortgaged real property is located in.

Web Theyll pay tax on the full 11400 rental income they earn. If line 2 is more than 20 or you refinanced your mortgage and received a reissued certificate see the instructions for the amount to. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

See If You Qualify To File 100 Free w Expert Help. Web Youll also be required to make a down payment usually between 10 and 20 percent to secure a home loan with no tax return. Web Mortgage interest paid on a home is also deductible up to certain limits.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Mortgage interest is tax deductible. With 100 Accuracy Guaranteed.

For example Lenas first-year interest expense. The exact amount will depend on the. Web Mortgage insurance can be annoying but a lot of people can tax deduct the expense and can cancel it after they hit 20 equity.

The co-owner is a spouse who is on the same return. Web Most homeowners can deduct all of their mortgage interest.

Airbnb Tax Returns Easybnbtax

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

Is It Essential To File An Itr To Avail A Home Loan Home Loan Without Itr

Services Umbrella Accountants

Lease Rental Discounting 20 Best Options Loanz 360

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Office Depot

My 20 Year Property Returns Fire V London

8 1 2 X 11 Z Fold 1098 Mortgage Tax Forms Box Of 500

Property Tax Protest Form To Quickly File Protest

3 Ways The Mortgage Tax Relief Changes Impact You Taxscouts

Mortgage Interest Statement Form 1098 What Is It Do You Need It

How To Lower Property Taxes Keeping Your Value Low Poconnor Com

Buy To Let Tax Changes Updated 2023 Propertydata

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax